Interim Management Spring Survey Results

Interim Partners recently conducted a survey amongst its interim managers to get a broader view of how interims have fared over the last 12 months and what they think the next year holds in store. Thank you to everyone who responded. We received a fantastic 1,500 replies to the survey, which gives us a good understanding of what our candidates have experienced as well as their predictions for the coming months. Following is a high-level summary of our findings.

Common to the experiences of much of the executive employment market many interims found the last year a challenging time. However, the good news is that interims now seem to be leading the executive market into the recovery.

One third (33%) of interims said that they were forced to drop their rates over the last year with only 20% managing to increase their rates over the last 12 months. Confidence is now returning, which means that 38% of interims expect pay rates to increase in the next 12 months.

Despite the recession the majority of interims still earn far more than they did as employees. According to the research 39% of all interims take home more than 20% more money as an interim than they did as a full-time employee.

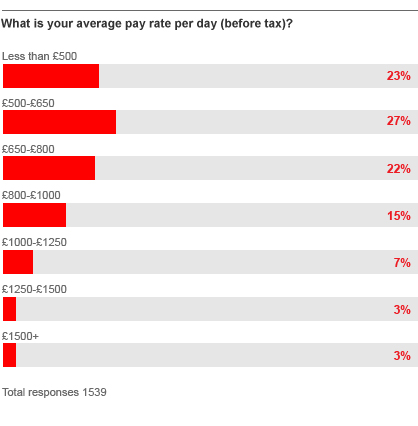

Currently, more than one in ten (13%) interim managers earn more than £1000 a day, while 74% receive over £500 a day. It is refreshing to see that very few interims move from traditional full-time employment primarily for financial reasons.

The biggest motivation for being an interim - selected by 46% - is the opportunity to work regularly on new challenges. Interestingly, 16% of interims say avoiding the office politics of full-time employment is their main reason for choosing the role!

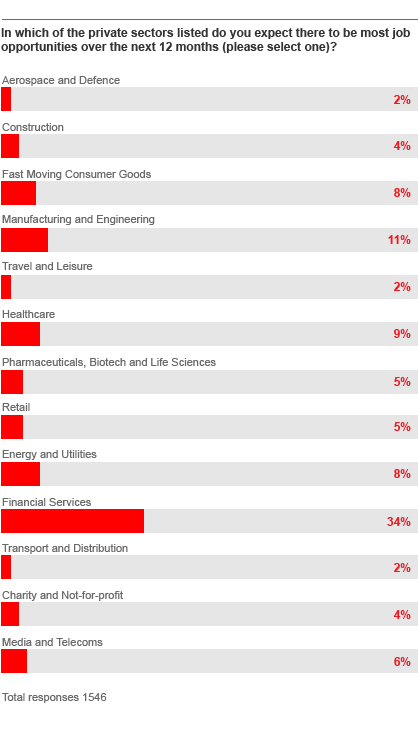

Just as the economy was led into the recession by the financial services sector it definitely seems that the recovery of demand for interims in that sector is building fastest. Over a third (34%) of interim managers believe that the highest private sector demand for interims will be in the financial services sector. Manufacturing and engineering comes a distant second with just 10% expecting demand to be highest in that sector. However, we shouldn't be surprised to see this gap in demand close if the economic recovery broadens its base.

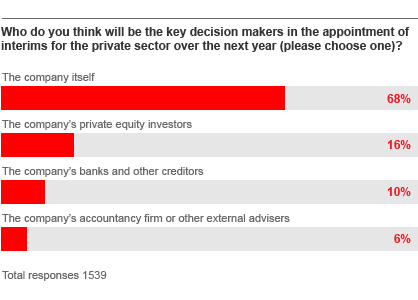

One trend that interims have noticed is for major investors and creditors of companies to get more heavily involved in the appointment of interim candidates. 16% of interims expect that private equity investors will be the key decision maker over appointments in the next year and a further 10% believe that a company's bankers will be making the final hiring decisions. 68% believe it is the company itself that will have the final say, which is historically low.

In the public sector, post election budget cuts are widely expected across the board except in the NHS, which has received assurances of ring-fenced funding from the two main political parties. Interims expect that this will drive their job opportunities. 45% expect the NHS to be the biggest public sector user of interims in the coming year. Second, with only 15%, was Central Government and third, following shortly behind with 14%, was Local Government.

So, as we head out of the recession, interims have a whole new range of challenges involving change to deal with. From what we are seeing in terms of instructions there is definitely a renewed sense of optimism.

Doug Baird, Managing Director of Interim Partners